The Ultimate Guide to Family Travel Insurance

Traveling as a family changes everything.

The way you plan, the way you pack, and definitely the way you think about “what ifs.” When it’s not just you anymore, those little travel hiccups can turn into big, expensive problems real fast.

After years of traveling solo and now traveling with a kiddo, one thing has become very clear to me: family travel insurance is a non-negotiable. It’s about protecting the time, money, and energy you’ve already invested into a trip that probably took months to plan.

This guide breaks down what family travel insurance is, what it actually covers, why it matters, and how to choose a plan that makes the most sense for your fam.

This post is written in partnership with WorldTrips. While this post is sponsored, all opinions are my own, and my goal is always the same: to help you make informed, confident travel decisions.

Why Family Travel Insurance Matters

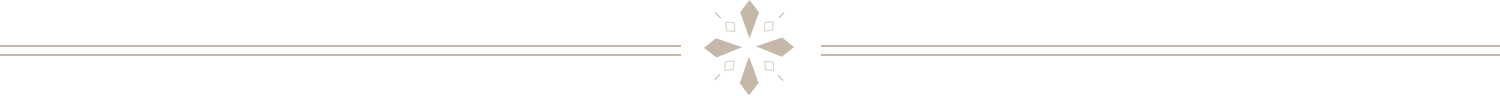

Family trips come with higher stakes. More people, more moving parts, and usually a much bigger upfront investment.

Here’s why I’ll never skimp on protecting my family:

- Family trips cost more upfront. Flights, accommodations, tours, and activities add up quickly. If you need to cancel, the financial hit is often much larger than it would be for a solo traveler.

- Kids get sick unexpectedly. A fever the night before departure or a stomach bug mid-trip can completely derail your plans.

- Delays get expensive fast. One delayed flight can mean meals, hotels, and transportation for multiple people, not just one.

- Lost baggage is more stressful with kids. Replacing clothes, medications, and essentials on the road is exhausting…especially with littles.

- Most domestic health insurance offers little to no coverage abroad. Many families assume they’re covered until they’re not.

Trip Protection Vs Travel Medical Insurance

One of the most common points of confusion is the difference between trip protection and travel medical insurance. They’re related, but they’re NOT the same thing.

Trip protection

- Trip cancellation for covered reasons

- Trip interruption

- Travel delays (meals, lodging, transportation)

- Lost or delayed baggage

Travel medical insurance

- Emergency medical treatment

- Hospital stays

- Emergency medical evacuation

- 24/7 travel assistance services

Many family plans bundle both, but coverage amounts and limits vary. And while some domestic health plans offer limited international coverage, relying on that alone can leave major gaps.

Benefits of Family Vacation Insurance

Being able to cover multiple travelers under one policy keeps paperwork and claims simpler, which is a lifesaver when you’re already juggling kids, schedules, and travel plans.

I also like that you’re not forced into a one-size-fits-all option. You can choose your deductible, coverage length, and overall coverage limits based on how your family actually travels.

For me, that flexibility makes it easier to balance protection and cost without paying for coverage that doesn’t make sense for our trip (no skydiving for us!).

10 Reasons to Get Travel Insurance for your Next Trip

Atlas Journey Family Trip Support

For U.S. residents, Atlas Journey is WorldTrips’ primary trip protection plan, and it’s designed to work well for family travel.

Depending on the plan level, it can include:

- Trip cancellation and interruption benefits

- Travel delay coverage

- Baggage protection

- Emergency medical benefits (depending on plan)

- 24/7 travel assistance

This type of coverage is perfect for family cruises, international vacations, or trips booked far in advance.

Optional Extras

Some trips call for extra flexibility.

Cancel For Any Reason (CFAR) is an optional upgrade available on select plans. Your standard trip cancellation benefit already reimburses you for covered reasons listed in the policy. CFAR on the other hand allows partial reimbursement (often 50% or 75%) if you cancel for reasons not covered, such as a change of plans or concerns about traveling.

There’s an important timing detail here. CFAR usually must be added within a set window after making your first trip payment, often within two to three weeks.

For families traveling with furry friends or arranging care at home, there’s also a Pet Care upgrade, which can provide cancellation coverage due to the illness or death of your pet, or vet coverage if your pet is hitting the road with you.

Claims & Documentation

No one likes dealing with insurance claims, but knowing what to expect helps a ton.

Here are a few of my top tips to ensure everything goes smoothly should you need to file a claim.

- Claims require LOTS of documentation and can take time to process

- Keep receipts (of EVERYTHING), medical reports, and proof of delays

- Read and re-read your full plan documents in detail before you travel

- A little organization upfront can save a lot of frustration later.

Tips For Choosing the Right Family Plan

Family travel insurance isn’t about finding the cheapest option. It’s about finding the right fit.

Just like you wouldn’t book a flight with three layovers when a direct option makes more sense, or choose a questionable motel when a comfortable hotel is within reach, insurance works the same way.

When choosing a plan:

- Decide what type of insurance fits your trip best

- Prioritize the benefits that matter most to your family

- Choose coverage limits and deductibles that match your risk tolerance and budget

- Know how much you could comfortably pay out of pocket if something went wrong

Final Thoughts

Family travel insurance isn’t about expecting the worst. It’s about giving yourself breathing room when plans change.

Trips with kids are full of unforgettable moments… and a few unpredictable ones.

Having the right insurance in place won’t stop things from going wrong, but it can make stressful situations feel so much more manageable.

As always, read the policy details super carefully and choose coverage that reflects how your family travels. When you’re far from home with the people you care about most, that peace of mind is worth every cent.

The post The Ultimate Guide to Family Travel Insurance appeared first on The Blonde Abroad.